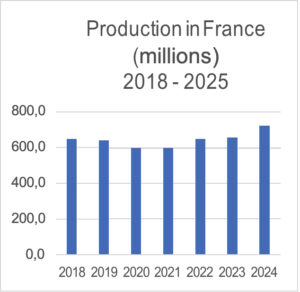

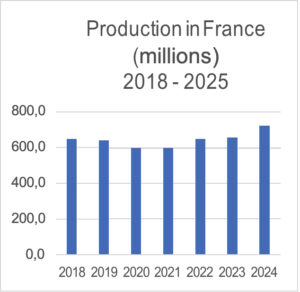

CFA: 2024 saw significant growth in French aerosol production volumes

This growth included the body care and 'other' segments.

The home care segment, on the other hand, is slightly down.

This progress in production shows the dynamism of the French industry in a market where consumers are attracted to aerosol dispensers as a safe, easy-to-use, inexpensive and recycled form of packaging, said the CFA.

The 2024 activity of filling aerosol dispensers shows growth, a trend already seen last year.

The French aerosol industry maintains its strong position in Europe (to be confirmed when FEA figures are published in September 2025).

Two growing segments

Body care increased by 4%, and there was a modest recovery in the anti-perspirant deodorant segment (+3%), a drop in shaving (-2%), and steady growth in hair care products (excluding dry shampoos) (+13%). On the other hand, the suncare / watersprays / dry shampoo / other body care segment showed strong growth (+10%).

The 'OTHER' category is the fastest-growing (+36%), but its constituent segments do not show the same trends.

The pharmacy and veterinary segment grew by 8%.

The auto/cycle, paint and industrial & technical products segment returned to its 2022 level (+43%), while the food/other segment took off with the strongest growth (+62%).

One decreasing segment:

Home care dipped by 5%, but the insecticides and horticultural products sub-segment is sharply up (+51%).

Filling activity by segment:

Body care

This category saw an increase of +4% for a total filling of 518 million units of aerosol generators in 2024, with this segment accounting for 72% of production.

Deo and antiperspirants: +3%

Slight growth in this segment, which is major in terms of application. The launch of new brands and the “easy to use” products may explain this phenomenon. Promotional activities may also have had an impact on demand. The segment accounts for 19% of French fillings.

Hair foams and lacquers: +0.5%

After declining in 2022, this segment grew strongly in 2023. It held steady in 2024, repre- senting the largest segment of total sales in France, at 22%.

Shaving foams and gels: -2%

This segment made good progress in 2023. In 2024, it lost two points and still represents 8% of production in France.

Suncare products, watersprays, dry shampoos, others: +10%

This segment grew by 30% in 2022, fell by 4% in 2023, and its growth in 2024 brings it back to a level well above that of 2019.

This category represents products that are highly versatile and quickly impacted by external phenomena such as fashion or weather. 2024 saw new brands launched, as well as new aerosol body care applications. The segment still represents a significant 23% of French production in 2024.

Home care

A drop of -5% for a total fill of 72 million aerosol dispenser units in 2024, representing 10% of total production.

Air fresheners: -9%

This segment had risen significantly in 2023. At the time, this increase was explained by promotional activities. In 2024, a readjustment seems to have taken place. The drop in production in this segment has not reduced its importance in relation to total production, since it still represents 5% of the latter.

Insecticides and horticultural products: +50%.

In 2023, this segment suffered a 55% drop. The catch-up in 2024 is undoubtedly linked to production movements from abroad. The product category is still popular with consumers, despite complex regulations.

The meteorological aspect continues to have a major impact (mosquitoes, hornets, etc.). This segment, which represented 2% of total sales in 2023, gained one point in 2024.

Carpet/textile care, furniture care, oven cleaners, bathroom and kitchen cleaners, leather and shoe care and other household products: -88%

This decline is the biggest of all segments in 2024. It is the first decline in several years of growth.

It may be explained by the relocation of these specific products, or by a drop in demand for kitchen and bathroom disinfectants. This segment fell from 4% of total production in 2023 to 2% in 2024.

Miscellaneous

A total volume of 133 million aerosol dispensers, up 36%, making up for a -35% drop in 2023. The segment recovers to 18% of total activity.

Auto & Bicycles / Paints & Varnishes / Industrial & Technical: +42%

This segment, which accounts for 13% of total sales, fell inexplicably by -43% in 2023 and 2024 brings it back in line with expectations. The need for these specific products remains constant, and the practical, efficient aerosol packaging contributes to their attractiveness.

Pharma / Veterinary (Excluding MDI): +8%

The growth of this segment, which will still account for 4% of total sales in 2024, is proof of France's mastery of the filling of complex products. Traditionally, France was the country where pharma was produced. This rapid growth is no exception.

Food and miscellaneous: +61%

This segment, which had remained stable in 2022 and experienced a decline in 2023, is on the rise again. This is relative in terms of volume, but the percentage impact is significant. This segment now represents 1% of total production.

The Statistics Committee welcomed the arrival of new products in France, such as cooking oil.

Production outlook 2025

"Our view is that supply disruptions had repercussions in 2023, and that these were less severe in 2024," said the CFA. "But this year, raw material costs and inflation are still present and still impacting purchasing power. But as in 2024, not all segments will be impacted in the same way."